Ever wonder how businesses work together so smoothly? The secret weapon might be B2B integration. It’s basically a digital handshake that automates communication and data exchange between companies.

According to a Partner Fleet study, a whopping 84% of businesses consider integrations “very important” or a “key requirement” for their customers. Moreover, B2B connection helps businesses increase their order fulfillment rates 16% and reduce order-to-cash cycles 25% (based on Aberdeen Group report)

Now, in this article, let’s break down what B2B integration is, why it’s awesome, and how it’s used in the real world.

What is B2B Integration?

B2B integration, which stands for business-to-business integration, acts as a digital bridge between companies, allowing them to connect and transfer data smoothly. Imagine sending an invoice or tracking inventory with a supplier, but everything happens electronically and automatically – that’s B2B integration in action! It streamlines processes, eliminates manual work, and keeps everything running efficiently between businesses.

In short, B2B integration automates how companies share information with each other, cutting out manual work and making everything run smoother.

Forget working standalone! Today’s business world thrives on strong ecosystem connections. Organizations need to seamlessly collaborate with everyone in their network – customers, partners, suppliers, and service providers – to achieve success.

Why is B2B Integration Important?

Let’s take a look at the daily work of an online retailer. Every day, they have to juggle hundreds of orders and communicate with various partners. So, we can easily see the huge amount of work they have to do manually. Therefore, connecting multiple systems can automate business processes, such as:

- Inventory management: automatically connecting with the suppliers in real-time to instantly reorder when the stock level is going down.

- Warehouse: connecting between warehouses and retailer’s systems to automate generating pick lists and packing slips.

- Customer experience: automate creating real-time shipping tracking (in the shipping platform) for customers after placing orders.

As the results show, B2B integration in this scenario creates a well-oiled machine, ensuring a smooth flow of information throughout the entire retail ecosystem, ultimately leading to happy customers and a thriving business. B2B connection isn’t just about efficiency; it’s the backbone of a successful, interconnected business world.

The Benefits of Integration In Each Industry

B2B integration unlocks a treasure trove of benefits for businesses across various sectors. Here’s a glimpse of how different industries leverage its power:

- Financial Services: Imagine streamlined loan approvals, faster fraud detection, and real-time account updates. B2B data integration connects banks, credit bureaus, and other financial institutions, enabling seamless data sharing and automated processes, leading to faster transactions and enhanced security.

- Healthcare: Patient care gets a significant boost with B2B integration. Electronic health records (EHRs) can be seamlessly shared between hospitals, pharmacies, and labs, improving treatment coordination and medication management. This translates to better patient outcomes and reduced errors.

- Logistics: B2B data integration is the engine that keeps the supply chain humming. Real-time inventory visibility across warehouses and carriers allows for optimized logistics planning, faster deliveries, and reduced transportation costs. It also helps avoid stockouts and ensures a smooth flow of goods.

- Manufacturing: Picture a factory floor where machines and production lines communicate seamlessly. B2B data integration connects design software with manufacturing equipment, enabling automated production processes and real-time quality control. This streamlines production, reduces waste, and ensures consistent product quality.

- Retail: B2B integration empowers retailers to create a seamless shopping experience. Real-time inventory updates from suppliers prevent stockouts, while integrations with payment gateways ensure smooth transactions. Additionally, customer data can be securely shared with loyalty programs, offering personalized promotions and a more engaging shopping experience.

- Software and Technology: B2B integration fosters innovation within the tech industry. Developers can leverage APIs to easily integrate third-party services into their applications, creating richer functionalities for users. Integration platforms also enable seamless data exchange between different software applications, streamlining workflows and boosting productivity.

Types of B2B Integration and Integration Testing

Types of B2B Integration

B2B integration isn’t a one-size-fits-all solution. Businesses have different needs when it comes to connecting with partners. To address this, B2B connection come in two main flavors, each focusing on a distinct aspect of data exchange:

Data-Level Integration

It focuses on the automated exchange of data between business applications. It handles core business processes like exchanging purchase orders, invoices, and inventory data. Common methods include:

- Electronic Data Interchange (EDI): standardized format for exchanging business documents electronically, ensuring compatibility between different systems.

- Application Programming Interfaces (APIs): APIs allow applications to communicate with each other, enabling the exchange of specific data between them.

People-Level Integration

It focuses on facilitating collaboration and communication between people from different companies. It can involve tools for:

- Joint project management platforms: These platforms allow teams from different companies to work together on projects, share documents, and communicate seamlessly.

- Real-time communication tools: Instant messaging platforms or video conferencing tools can streamline communication and collaboration between business partners.

B2B Integration Testing

Once a B2B integration is set up, thorough testing is crucial to ensuring it functions as intended. Integration testing verifies whether the data flows accurately and triggers the desired actions between different systems. It can involve:

- Functional testing: verifying if the integration performs the intended tasks as planned.

- Performance Testing: Assessing the speed, reliability, and scalability of the integration under various loads.

- Security testing: ensuring that data is transmitted securely and protected from unauthorized access.

B2B Integration Process

Now, we know what B2B integration is and its importance in business. But, how exactly does it work? B2B connection follow a well-defined process that ensures seamless communication and data exchange. Let’s break it down step-by-step.

Step 1 – Building the bridge: Establishing a Data Connection

The first step is creating a connection between the two business systems. This is like building a bridge for data to flow across. There are different options available, each with its own strengths:

- Electronic Data Interchange (EDI): This established method acts like a universal language for business documents. It ensures data is formatted in a standardized way, allowing even completely different systems to understand each other.

- Application Programming Interfaces (APIs): APIs offer more flexibility. They act like digital messengers, allowing applications to directly communicate and share specific data points with each other.

- Cloud-based Integration Platforms (iPaaS): These platforms act as intermediaries, providing pre-built connectors specifically designed for cloud-based applications. They streamline the connection process, making it faster and easier to get started.

Step 2 – Exchanging the data

Once the connection is established, the real magic happens – data exchange! The chosen method dictates how data flows between the systems:

- EDI: Data is securely transferred between systems using a pre-defined format that both understand.

- APIs: Applications “talk” to each other using APIs, sending and receiving specific data points as needed. This allows for a more dynamic exchange of information.

- iPaaS: The platform acts as a middleware, such as HexaSync, transferring data between the connected applications.

Step 3 – Transforming & mapping data

Businesses often use different internal systems, and their data might not be formatted the same way. This is where data transformation and mapping come into play:

- Transformation: The incoming data may need to be converted into a format compatible with the receiving system. Imagine changing currencies or converting units of measurement. In some cases, the entire data structure might need to be reorganized.

- Mapping: Data fields from the incoming data are mapped to corresponding fields in the receiving system. This ensures the data is interpreted correctly and used for its intended purpose.

Step 4 – Integrating data

The final stage is where the transformed data finds its new home. It’s integrated into the receiving system’s database or application, ready to be used. This could involve:

- Updating inventory levels in a warehouse management system based on real-time data from a supplier.

- Triggering automated workflows based on received data, such as generating invoices or sending shipment notifications.

- Populating customer information in a CRM system for better customer service.

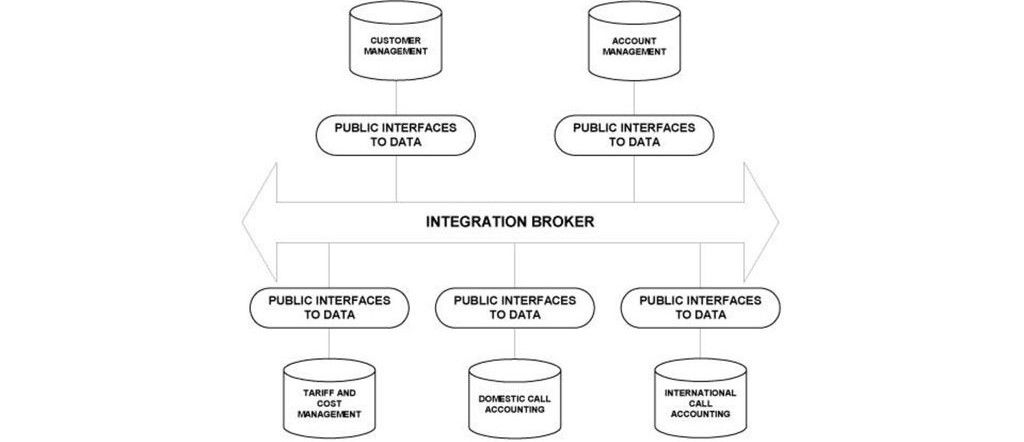

What is B2B Integration Platform?

The B2B integration platform is a software solution that allows businesses and applications to seamlessly connect and exchange data in various organizations. It acts as a central hub for standardizing and automating the transfer information in business ecosystems. By connecting disparate systems, a B2B integration platform ensures that data flows smoothly and accurately between businesses, enhancing efficiency, reducing manual errors, and enabling real-time collaboration.

So, what basic and advanced elements should a B2B integration platform have?

A B2B integration platform is able to offer a range of functionalities to bridge the gap between multiple organizations. Let’s explore the essential building blocks that make iPaaS such a powerful tool, categorized into basic and advanced elements.

Basic B2B integration elements: Streamlining the foundation

B2B integration platforms (iPaaS) offer two tiers of functionality. The core features that ensure smooth communication:

- Data translation & mapping: Seamless data exchange between different systems, regardless of format.

- Secure communication: Encryption and secure protocols for worry-free data transmission.

- Real-time data exchange: Up-to-date information across business processes for better decision-making.

- Workflow automation: Automatic actions based on incoming data to streamline repetitive tasks.

Additional features enhance the iPaaS experience:

- Scalability: Grows with your business, handling increasing data volumes.

- Monitoring & reporting: Tracks data flow, identifies issues, and generates reports.

- User-friendly interface: Easy setup, management, and monitoring for all users.

- Compatibility: Integrates seamlessly with various software applications and legacy systems.

Advanced B2B integration elements: Taking collaboration to the next level

Advanced iPaaS takes B2B integration software beyond the basics:

- AI & Machine Learning: Gain a competitive edge with smarter data analysis and decision-making.

- Blockchain Integration: Build trust and streamline collaboration with tamper-proof data exchange.

- IoT Integration: Unlock valuable insights from connected devices for improved operations.

Seamless Business Automation with the HexaSync Integration Platform

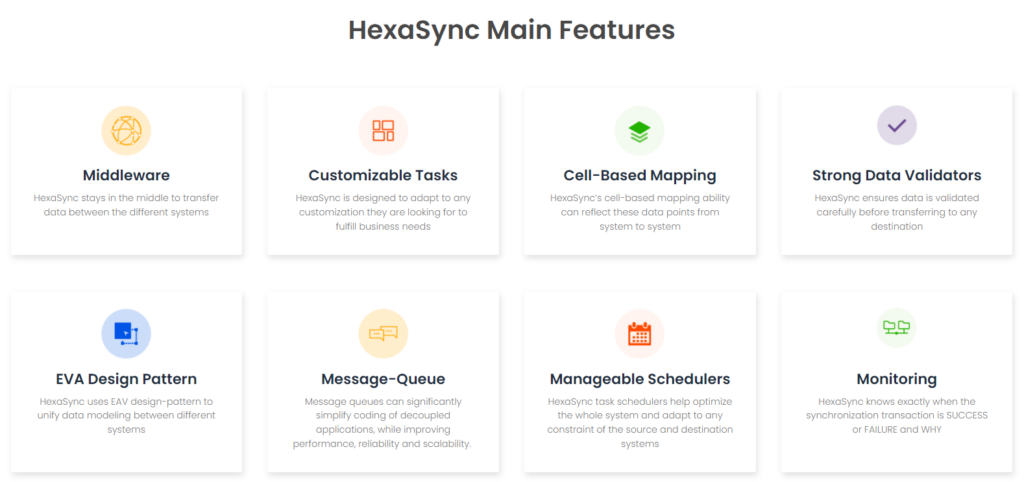

HexaSync, developed by Beehexa, is one of the iPaaS integration platforms in the global market. Working as a middleware platform, HexaSync facilitates businesses to connect and synchronize data between two or more systems, applications, or platforms, including integration between legacy systems and modern SaaS applications. With high flexibility, users can integrate any data, application, or system, depending on their needs and finances, through APIs.

Using HexaSync integration platform for B2B integration solutions allows users to easily track data from the source to the destination system. Therefore, businesses can easily detect errors, know the cause of the problem, and even fix the error themselves if it is not a professional technical error.

Some B2B integration task that HexaSync can optimize for your businesses:

- Marketplace Integration

Conclusion

B2B integration enables organizations to communicate and share information as easily as sending a text. It breaks down communication barriers, automates tasks, and keeps data flowing securely. By working together seamlessly, businesses can unlock new efficiencies, gain a competitive edge, and ultimately achieve greater success. It’s the key to a more connected and collaborative business future.

If you have any questions about integration and want to connect any systems, please contact us.