Accounting software is one of the most important pieces of software every business needs to manage its entire business and to improve financial management.

According to research done by InnoScope Insights, the Global accounting software market was valued at USD 14183.89 million in 2022 and is expected to expand at a CAGR of 6.73% during the forecast period, reaching USD 20962.99 million by 2028.

Today we will dig into one of the most popular accounting software companies, Quickbooks.

QuickBooks Overview

Intuit is a corporation founded in 1983 by Scott Cook and Tom Proulx, headquartered in Mountain View, California, United States. Since its Quicken product for personal finance management became a huge success, Intuit has expanded its reach by developing similar services aimed at small businesses, among which QuickBooks is a prominent name.

Its mission is not only to provide effective financial solutions but also to support and develop the small and medium-sized business community, helping them enhance their management and business development capabilities in an increasingly complex and competitive business environment.

According to many sources, QuickBooks was born in 1992 and exploded in popularity in the 2010s. By May 2014, QuickBooks Online had attracted the attention of many people, gaining a large number of global users with 624,000 registered users, far surpassing the number of users of competitor Xero (reportedly as of July 2014, there were only 284,000 customers).

The cloud version of QuickBooks Online has been developed differently from the traditional desktop version, with many different operational features and interoperability, helping to meet the diverse needs of users.

QuickBooks holds a market share of more than 60% in the global accounting software market and over 80% in the US. During the same period last year, QuickBooks Online Accounting revenue increased by 34% to USD 623 million.

The online ecosystem includes revenue from:

- QuickBooks Online, QuickBooks Online Advanced, QuickBooks Live, and QuickBooks Self-Employed business and financial management services.

- Payroll services for small businesses – QuickBooks Online Payroll, Intuit Full Service Payroll, Intuit Online Payroll.

- Merchant payment processing service for small businesses using online services.

- QuickBooks Cash, QuickBooks Commerce, and Small Business Financing.

The revenue generated from the online ecosystem accounts for 59% of the total revenue generated by the company. It grew from USD 1,181 million in Q1 2021 to USD 1,443 million in Q1 2022, marking a 22.18% year-over-year growth, which is incredible for an incumbent giant in this field.

What is QuickBooks?

QuickBooks is a platform designed to help businesses manage their finances. Includes support features for finance-related work for SMB and enterprise businesses, such as Invoicing, Expense Tracking, Payroll Processing, Financial Reporting, Tax Preparation, and Inventory Management.

QuickBooks helps business owners simplify these tasks and more easily track their financial activities without the need for in-depth accounting knowledge.

How does QuickBooks work?

Once signed up, users will be given the option of a 30-day free trial that they can take advantage of before having to part with their cash. This is a good opportunity to explore what QuickBooks Online is for and whether it’s right for your business.

Features are aimed at freelancers, small and medium business owners, or large enterprises. Because of QuickBooks’s flexibility and its openness to app developers, it has built a powerful and convenient ecosystem for users.

These include charitable donation management, scheduling, time tracking, document management, payment processing, and inventory management, just to name a few.

These integrations and compatible tools enable users to manage and automate a variety of business processes.

How many versions do QuickBooks have?

- QuickBooks Online: Uses the cloud to store information, allowing users to manage their accounts from any device with internet access.

- QuickBooks Desktop:

- QuickBooks Pro Plus: Provides core accounting features suitable for small businesses.

- QuickBooks Premier Plus: Includes all Pro features plus additional tools tailored to specific industries such as nonprofits, manufacturing & wholesale, professional services, contractors, and retail.

- QuickBooks Enterprise: Offers the most comprehensive features for mid-sized businesses with advanced reporting and inventory management capabilities

- QuickBooks Self-Employed: Designed for freelancers, contractors, and sole proprietors, this version helps track income and expenses and is especially helpful in managing tax deductions.

- QuickBooks Mac Plus: Designed specifically for Mac, providing a better and easier experience for users in this segment.

| QuickBooks Online | QuickBooks Pro Plus | QuickBooks Premier Plus | QuickBooks Enterprise | QuickBooks Self-Employed | QuickBooks Mac Plus | |

| Business Size | Small-Medium | Small-Medium | Medium | Large | Freelancer | Small-Medium |

| Number of Users | 1-25 | 1-3 | 1-5 | 1-40 | 1 | 1-3 |

| Highlights | Easy to use, cloud-based software, 650+ integrations | Advanced features, 200+ integrations | Industry-specific features, advanced features | Supports up to 40 users, advanced features, advanced inventory & pricing | Easy to use, designed for freelancers, good tax support | Designed for Macs, easy to use, numerous features |

Notes:

- After May 31, 2024, access to add-on services for Windows will be discontinued for QuickBooks Desktop 2021. This includes all 2021 QuickBooks Desktop Pro, Premier, Enterprise Solutions, and Accountant Edition 2021 versions.

- Users have to upgrade their QuickBooks Desktop 2021 by May 31, 2024. Users can learn more about the innovations between QuickBooks Online and Desktop to make the optimal choice.

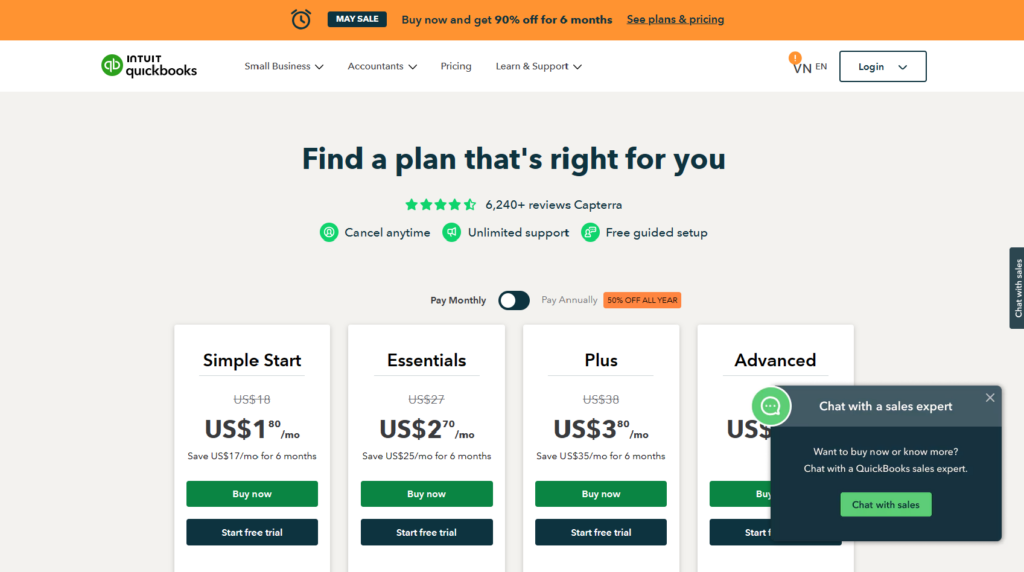

QuickBooks Pricing

QuickBooks Online is available both as a desktop application and an online SaaS (software as a service) model. QuickBooks Online also offers various pricing plans for different business needs:

Small business pricing

| Plan | Price | Features |

| Simple Start | $25/month | 1 user + 2 accounting firm users Track income & expenses Invoice & accept payments Maximize tax deductions Run general reports Capture & organize receipts Track miles Manage cash flow Sales and sales tax tracking Send estimates Manage 1099 contractors |

| Essential | $50/month | Simple start features, plus: 3 users Manage and pay bills Time tracking |

| Plus | $80/month | Essential features, plus: 5 users Inventory tracking Project profitability tracking |

| Advanced | $180/month | Plus features, plus: 25 users + 3rd accounting firm user Business insights and analytics Invoice and expenses batching Customizable access by role Exclusive premium apps Dedicated account team, on-demand online training Automated workflows Company data restoration |

Self-employed pricing

| Plan | Price | Features |

| Self-employed | $15/month | Separate business and personal expenses Optimize Schedule C deductions Quarterly tax estimates are automatically calculated Automatic mileage tracking |

| Self-employed Tax Bundle | $25/month | Self-employed features, plus: Pay estimated quarterly taxes directly through online QuickBooks Transfer information to TurboTax One state and one federal tax return filing |

| Self-employed Live Tax Bundle | $35/month | Self-employed Tax Bundle features, plus: Real Certified Public Accountant (CPA) on hand to provide assistance Unlimited advice year-round CPA final review of your return |

Payroll

Once you select your business plan, you can also optionally add a payroll plan. There are three different packages to choose from. These also work with a monthly subscription fee

| Plan | Price | Features |

| Payroll Core | $45 + $4/employee/month | Full-service payroll Includes automated taxes and forms Auto Payroll Health benefits for your team 401(k) plans 1099 E-File & Pay Expert Product Support Next-day direct deposit |

| Payroll Premium | $75 + $8/employee/month | Payroll Core features, plus: Same-day direct deposit Workers’ comp administration HR support center Expert review Track time on the go |

| Payroll Elite | $125 + $10/employee/month | Payroll Premium features, plus: Expert setup 24/7 expert product support Track time and projects on the go Tax penalty protection Personal HR advisor |

Reasons to Use QuickBooks for Small Businesses

- Ease of use – QuickBooks is user-friendly and relatively easy to learn. This is important because you want to focus on running your business instead of mastering complex software.

- Flexibility – QuickBooks is flexible and suitable for businesses of all sizes and industries. With expandability, QuickBooks App is also a tool for small businesses to expand their management capabilities.

- Time-saving features – QuickBooks automates many tedious and time-consuming financial management tasks, giving you more time to focus on other aspects of your business.

- Comprehensive reporting – QuickBooks provides users with valuable insights and data that can help make business decisions.

- Affordable – QuickBooks is a cost-effective solution for businesses, especially when compared to other accounting software options on the market.

- Security – QuickBooks takes data security very seriously and uses a variety of measures to protect users’ data from compromise.

- Support – QuickBooks offers excellent customer support, ensuring you can always get help when you need it.

- QuickBooks API – Intuit has developed a comprehensive and accessible developer portal that has contributed significantly to the explosive growth of their application ecosystem. Facilitate feature development for QuickBooks Integration for solution providers around the world

Conclusion

QuickBooks for small businesses is one of the best financial management software picks. QuickBooks pricing is also ideal for small businesses, allowing them to run bookkeeping effectively. Moreover, it is easy to set up and works with most ePayments solutions for excellent expense, Payroll, and sales management.